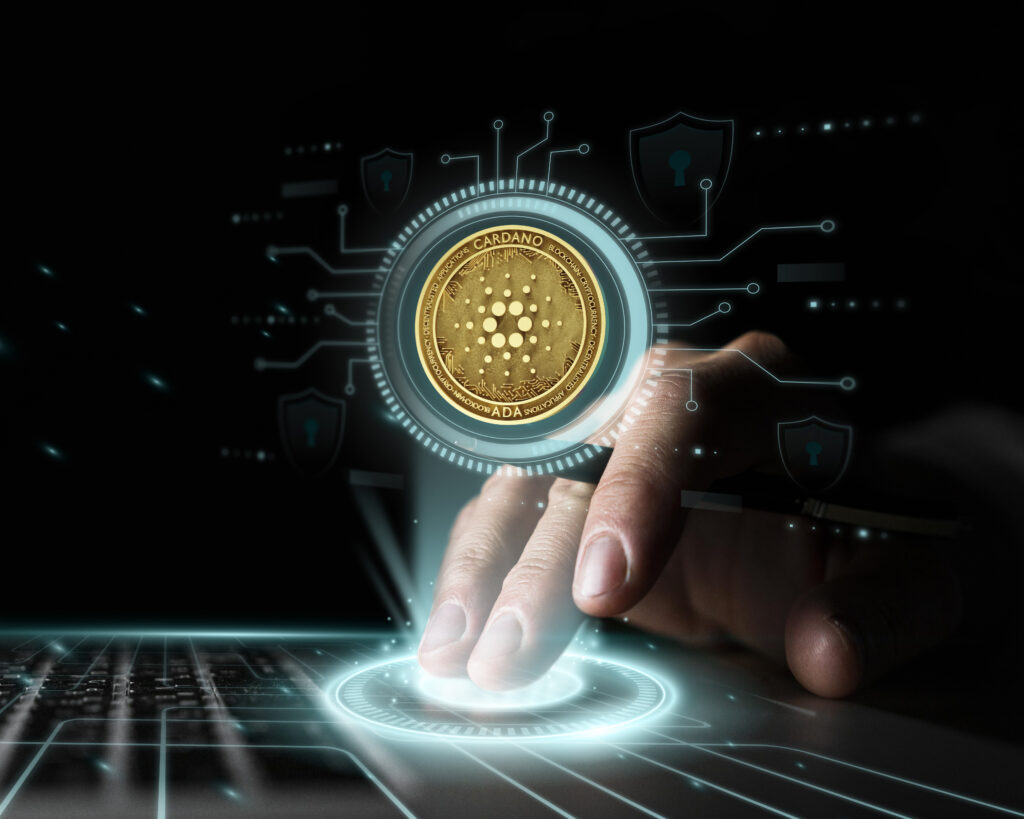

Selling cryptocurrencies is a fundamental aspect of the digital asset landscape, and it demands careful consideration to ensure a smooth and secure transaction. Whether you’re a seasoned crypto user or a beginner, understanding the best practices for selling crypto using a Cash App alternative is crucial to protect your investments and potentially maximize returns.

In this comprehensive guide, we will delve into the key strategies and precautions to follow when selling cryptocurrencies.

Preparing for the Sale

a. Set clear objectives.

Define your goals for selling crypto. Are you looking to cash out for fiat currency, diversify your portfolio, or lock in profits? Having a clear objective will help you determine when and how much to sell.

b. Assess the market condition.

Although the crypto market is unpredictable, it’s crucial to assess market conditions before selling, especially when you don’t need to cash out your funds.

How’s your portfolio? Are you down or up? Analyzing whether it’s an opportune moment to sell based on factors such as market sentiment, news events, and price trends can significantly impact your decision.

c. Research tax implications.

Cryptocurrency transactions may have tax implications depending on your jurisdiction. Consult with a tax professional for compliance and to understand the potential tax consequences of your sale.

Selecting the Right Platform

a. Choose a reputable platform.

Be sure to read about several platforms before using one, whether you’re looking for a crypto payment app, crypto exchange, or any other platform that allows you to sell crypto. Consider strong security measures, a solid track record, the availability of your preferred crypto, a user-friendly interface, and good customer support.

b. Prepare your documents for identity verification.

Many reputable crypto platforms require Know Your Customer (KYC) checks for withdrawals and large transactions. Be sure to prepare your documents ahead of time to prevent delays, including a valid ID and proof of address.

Managing the Sale

a. Determine the amount of crypto you want to sell.

Based on your objectives and market conditions, decide how much cryptocurrency you want to sell. Be mindful of potential fees associated with the sale.

b. Set realistic price targets

If you’re using an exchange, remember to avoid emotional decisions when setting your selling price. Consider using limit orders to specify the exact price at which you are willing to sell.

c. Beware of market volatility.

As you know, the crypto market is volatile, so be prepared for sudden price fluctuations and potential slippage when executing large orders.

d. Choose the right withdrawal method.

Select a withdrawal method that suits your needs. Some of the most common ones include converting crypto to cash and transferring funds to a bank account, sending crypto directly to a friend in exchange for cash, withdrawing through a crypto automated teller machine (ATM), etc.

Post-Sale Considerations

a. Keep records of your transactions.

Maintain detailed records of your cryptocurrency sales, including transaction dates, amounts, and counterparties. This information is invaluable for potential tax requirements and portfolio tracking.

b. Assess and reevaluate.

After completing a sale, evaluate the outcome against your initial objectives. Assess the impact on your portfolio and consider potential reinvestment opportunities.

c. Stay informed.

The crypto landscape is ever-evolving. Continue to stay informed about market developments, regulatory changes, and emerging opportunities.

Thinking Security and Risk Management

a. Establish your own security measures.

Don’t just rely on the technology and security of the platform you will use. Some safety precautions you have to keep in mind include using strong and unique passwords, avoiding public Wi-Fi networks, updating your software regularly, and installing an antivirus and/or antimalware, among others.

b. Beware of scams.

You can also exercise caution by avoiding scams and phishing attempts. Be skeptical of unsolicited offers, and never share your private keys or sensitive information.

c. Diversify your holdings.

Diversification can help mitigate risks associated with volatility. Consider reallocating your proceeds into a mix of assets to spread the risk.

The Bottom Line

Selling crypto is a strategic process that requires careful planning and adherence to best practices. By following the advice/tips outlined above, you can maximize the benefits of your crypto sales while minimizing potential risks. As always, remember that the crypto market is dynam

Learn Java Java Tutoring is a resource blog on java focused mostly on beginners to learn Java in the simplest way without much effort you can access unlimited programs, interview questions, examples

Learn Java Java Tutoring is a resource blog on java focused mostly on beginners to learn Java in the simplest way without much effort you can access unlimited programs, interview questions, examples